Best place to buy cheap replica watches. And the best aaa+ swiss made grade 1 replica watches on our website with fast shipping.

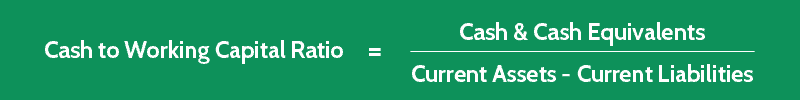

When you hire an outsourced team, you don’t have to invest in training and setup costs. Our team of software experts can help you select, implement, and learn the accounting software that’s right for your business. As you grow, having a professional, outsourced accountant on your side gives you the advantage of proactivity rather than reactivity. Trained accountants can spot red flags ahead of time and notify you about things like cash flow discrepancies.

How to Tell If an Outsourced Accounting Firm Is Good or Not

Without a timely and accurate cash flow forecast, your company may run into future problems and surprises, which is why financial modeling is so important. By creating financial models with a wider range of inputs, you’ll be able to predict future outcomes and opportunities more accurately and plan accordingly. We help leaders safeguard financial health by transforming principal accounting processes to optimize business performance and give them the power to manage the future with real-time insights. Today’s finance function is in a unique position to drive positive change for the business.

Outsource Access

But with recent technological advancements, it’s now common for the business and the accountant to never actually meet in person. Companies have a global pool of experts to tap into, and it has become easier for them to discover a finance and accounting partner that meets their needs. Recent trends have seen companies outsourcing more complex and valuable functions such as financial analysis, forecasting, and budgeting.

Advantages of Working With An Outsourced CFO

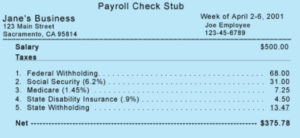

Of all the outsourced accounting services, an outsourced CFO service is by far the most customizable. Whereas outsourced bookkeeping and outsourced controller work largely follow a predefined framework, an outsourced CFO relationship can be anything you want it to be. Today, the average salary for a bookkeeper in the U.S. is $45,160, the average controller earns $104,338, and the median CFO salary is $393,377. By comparison, outsourced accounting services typically cost a fraction of these rates and deliver better results. Today, many outsourced accounting providers are purpose-built for the needs of private businesses, from closely-held family businesses to well-established mid-market firms.

If You Need Location-Specific Accounting Services

Once the trial project is done and analyzed, you should have a clear picture of how well an outsourcing provider fits your financial and accounting needs. Quality of work and quality of team members are both equally critical for those considering outsourcing their financial department. If you are unable to find quality workers in your area, then outsourcing might be the only option left for you. Quality is probably the most important factor that drives companies to outsource their financial department. Aprio has experts who understand the accounting and non-accounting needs of family offices. For start-up businesses, Aprio experts can set up your accounting systems with real-time, accurate information and forecasting tools.

Is it time to invest in additional people and new software to boost your business’ efficiency? Outsourcing some or all financial processes can allow your company more time to focus on core parts of your growing business, offering better opportunities in the long https://www.intuit-payroll.org/ run. Many businesses spend more time, money and energy on their back-office operations than they’d like. Our FAO services provide access to an enhanced suite of technology-based services tailored to meet your organization’s finance and accounting needs.

The majority of companies that work with an outsourced accounting firm do so on an ongoing basis. At first, there may be a lot of work in building the financial infrastructure and accounting services. But after this initial set-up period, the relationship typically reverts to a stable monthly business cycle. InDinero offers tax, accountant, and financial services for businesses of all sizes. Some of their solutions include CFO services, accounting and bookkeeping services, tax services, and financial reporting. Our firm takes a personal approach in working with clients to assist them in seeking out and resolving operational and financial issues.

Aprio Wealth Management, LLC and Purshe Kaplan Sterling Investments, Inc. are separate and unaffiliated. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed here. Aprio advisors will provide you with real-time financial insights into your ledger, by automatically synching your marketplace data. We can help streamline your sales tax compliance needs, and help you with inventory, managing your margins and more. Aprio combines best-of-breed technology solutions with our accounting, payroll, and tax advisors to give you peace of mind. Our integrated visual dashboards inform, at a glance, how your business is performing with up to date budgets, sales, payroll, tax obligations, inventory and more.

With Bench’s Catch Up Bookkeeping services, a Bench bookkeeper will work through past months of disorganized bookkeeping to bring your accounts up to date. As you evaluate different outsourced CFO options, there are several things to bear in mind to ensure you make the right choice. By keeping these considerations in mind, you’ll be able to avoid any of the drawbacks that can impact businesses that partner with an outsourced CFO that isn’t a great fit for their business. Chief Financial Officers (CFOs) provide invaluable leadership in businesses all around the world. Their job is to head up a business’s financial strategy, designing and implementing financial systems and processes that enable the business to operate more efficiently. With the right partner, it’s possible to mitigate these downsides entirely, but to do that, you need to be aware of what to be on the lookout for.

Plus, you also get visual reports of your monthly financial statements and expense overviews with real-time insights on where to spend and where to save. They focus on tech start-ups with an unlimited number of connected accounts. The monthly services include financial statements and double-entry bookkeeping wikipedia transaction categorization. A flexible service will handle invoices, payrolls, income, and expense reports. It also manages monthly accounts, financial reports, taxation, bank, and credit statements. Make sure that your requirements tally with the critical features of the service.

Witness Diana’s journey from establishing her CPA firm in the 2020 to harnessing the power of outsourcing, resulting in remarkable client expansion and increased profitability. Lessons learned on how top firms grow fast, build stronger teams, and increase profit while working less. Paro begins the process with an introductory call to learn about the scope of work your firm needs. Then, they connect you with a professional from their network with the right expertise for the job.

Many outsourced accounting service providers offer completely bespoke packages to their clients. You’ll have the ability to add supplemental services as the needs of your business change. https://www.personal-accounting.org/the-balance-in-the-prepaid-rent-account-before/ With the QXAS Tracker App, you can monitor the progress of your accounting tasks in real-time. It is one of the best outsourced accounting services with certified accountants.

It allows owners to devote more time and resources to core business functions like strategic growth and nurturing customer relationships, which are crucial for long-term success. Continue reading to explore more ways small businesses can thrive through outsourced accounting. QX is your go-to partner for reliable, efficient, and high-quality accounting outsourcing services, committed to enhancing the operational effectiveness of CPAs and accounting firms.

- Our outsourced financial planning and consulting team partners with your in-house accounting team, bookkeeper, or staff accountant(s) to create clarity and confidence in your company’s financial reporting.

- Bench is a dedicated online platform for small business owners to outsource bookkeeping and income taxes services.

- At LBMC, our mission is to support entrepreneurial businesses at every stage to go further.

Leverage the power of an outsourced accounting team to build more efficient workflows and accelerate turnaround times for clients. Permanently increase your firm’s capacity with a dedicated outsourced accounting team in weeks, not months. Outsourcing is a tried and tested resourcing strategy that typically sees businesses identify repetitive and time-consuming tasks and assign them to third-party team members in another location. At QX Accounting Services, we assess your accounting firm’s requirements and offer flexible engagement models with PTEs/FTEs with a managed approach for that extra layer of review. However, Merritt can still recommend a solid payroll provider or tax consultant who meets your needs. Unlike most other outsourced bookkeepers on our list, Merritt Bookkeeping doesn’t offer any in-house add-ons for payroll and tax services.